Markets got a little uncomfortable through the Capitol Riot and breach on January 6. Perfect time to make some entries as the selloff flowed after the strong run.

Portfolio News

Big moves in my portfolio in the last week. Just a few examples

Sunrun (RUN) up 39%; Tilray (TLRY) up 36%, Cronos Group (CRON) up 30%, Scorpio Tankers (STNG) up 22%, Pilbara Minerals (PLS.AX) up 26%, Cobalt Blue (COB.AX) up 39%, Glencore (GLEN.L) up 18%, Castillo Copper (CCZ.AX) up 26%.

This gives some key themes that are on a tear - solar power, marijuana, alternate energy (three of the names are in cobalt and lithium). The Glencore move also includes copper. The copper move tells me that underlying all the covid stuff there seems to be a swell of activity building.

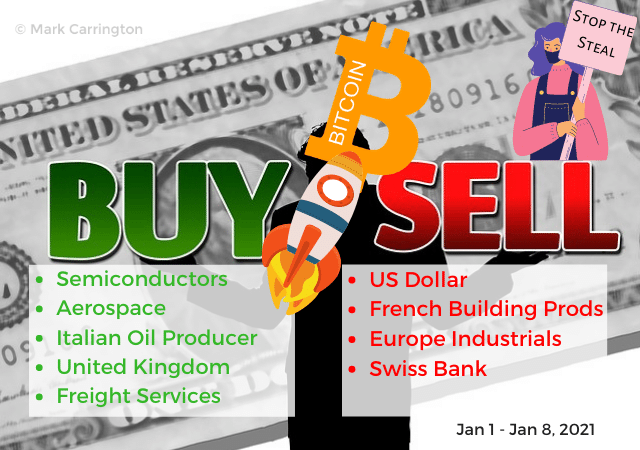

Bought

Used January 6 selloff day to do some averaging down.

Eni S.p.A (ENI.MI): Italian Oil Producer. With some life in oil markets, averaged down with a small add. Dividend yield 6.07% - not sure they can keep that up.

Lyxor Core Morningstar UK NT ETF (LCUK.DE): UK Index. While US and European markets have had a positive 2020, FTSE has lagged and had a losing year. I figured that with the Brexit deal agreed and vaccine beginning to rollout, most of the downside is priced in. This is a contrarian trade if ever there was one. Note: I bought the EUR listed ETF which hedges the GBP exposure to Euros. Dividend yield 3.40%.

United Parcel Service, Inc (UPS): US Freight Service. Initiated position at size enough to write covered calls. Dividend yield 2.55%. Jim Cramer idea.

Advanced Micro Devices, Inc (AMD): US Semiconductors. Averaged down entry price and filled out position to 100 shares to be able to write covered calls. Jim Cramer idea

The Boeing Company (BA): US Aerospace. Averaged down entry price on the day Boeing 737 Max resumed flying in US and on reviewing the Defense Appropriation Bill which has provision for a big revamp of US nuclear ability. Boeing will get some of that. Jim Cramer idea

Alerian MLP ETF (AMLP): US Oil Producers. Averaged down with oil price improving.

PepsiCo, Inc (PEP): US Beverages. Added to small holding. Jim Cramer idea.

Sold

Gascogne SA (ALBI.PA): French Building Products. Sold for 5.2% blended profit. Initially bought as a breakout trade in January 2017 identified by my investing coach. It never did make the grade. I averaged down in November 2020 with a view to exiting at or above breakeven. Original report goes back as far as TIB21.

ABB Ltd (ABBN.SW): European Industrial. With price opening at SFr 25.46, I rolled up December 22 strike 24 and June 21 strike 25 call options to December 23, strike 26 call options. Locks in 26% profit since August 2018 and 8% profit since February 2020 respectively, and also consolidates positions into a single position.

The chart shows the new trade as a green ray with expiry on the far right side. Price moves up are very consistent - the green arrows are clones of those. Trade will need two of those to get to profit.

UBS Group AG (UBSG.SW): Swiss Bank. With price opening at SFr 12.98, I rolled up December 21 strike 12 call options to December 21, strike 14 call options. This rollup adds to the holding in that contract and averages it down from the initial entry. Locks in 97% profit since February 2020

Shorts

Continue to use gold and silver mining as hedge trades with covered call and naked put writtten on Yamana Gold (AUY).

Cryptocurrency

No crypto action this week as Bitcoin rockets through $25,000 to touch $40,000 on January 8.

Income Trades

Covered Calls

China Unicom (CHU): China telecom. Bought back part of a covered called written on China Unicom (CHU). China Unicom is in the list of stocks banned by Donald Trump because of connections to China military. NYSE has been back and forth about what it should do. I was not fully executed - then decided to leave the contract in place as there can be no exercise. The loser is the person who bought the contract from me. I will transfer the stock holding I have to Hong Kong listing if I can. As I am not an American resident, the order does not apply to me.

Carrefour SA (CA.PA): French Supermarket. Covered call I wrote in December only had a multiplier of 10 and no the normal 100. Bought back the 2 contracts and replaced them with 2 contracts with a 100 multiplier. Did take a small loss doing that as price had moved through the sold strike - luckily it was just for 20 shares and not 200.

Covered calls written on AMD and STNG

Naked Puts

Write naked puts on a few stocks on Jim Cramer shopping list - as he adds them to the bullpen, I wrote a naked put 10% below the current price with one month to expiry. That way I earn income and if I get assigned I will be entering about the level he is happy to enter. Naked puts written on UPS, JNJ, PEP and JKS.

During the week I will resume the spreadsheet showing cumulative returns.

Currency Trades

No currency trades this week - not yet got new PC set up to trade forex. Maybe this coming week.

US Dollar has been under massive pressure. My gut tells me this is what is driving Bitcoin price. I looked at currency markets to explore a way to trade the continuation. I did set up a bear put spread on USDJPY for April expiry - bought 102 strike put and sold a 100 strike put. Not looking good right now. I will show the chart as there are lessons here

Let's look at the chart which shows the bought put (102.70), and breakeven as red rays and the sold put (100) as a blue ray with the expiry date the dotted red line on the right margin. Trade entry was where the red ray begins. Lesson one is right there - will the fall continue? That is why I went for a 3 month option contract and why I did a bear put spread. Lesson two shows that price has not been as low as the sold put strike in all of 2019 and 2020. It did go there before that is what was in my head. This is a major shift in funds flows going on. The channel trader in me sees a chance for price to respect the downtrend and trade back to the bottom of the channel. That takes the trade to breakeven - but price does have to respect the top of the channel.

Change the chart to a weekly and we see a few visits to 100 in 2014 and 2016 (and right down to 75 in 2012). The test: Was 3 months enough. I might well bank the profit on the sold put and go again at the top of the channel.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

December 28 2020 - January 8, 2021.

Posted Using LeoFinance Beta

Edits added: Additional trades - Bought Alerian MLP ETF (AMLP) and PepsiCo, Inc. (PEP) and wrote covered calls on AMD and STNG.