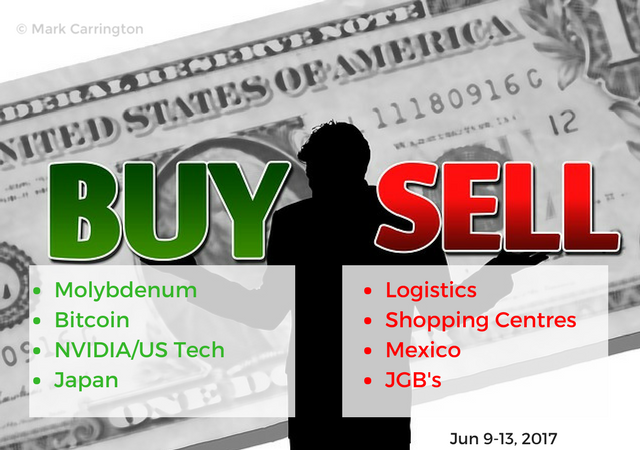

TIB: Today I Bought (and Sold) - An Investors Journal #95 - Japanese Government Bonds, US Tech, Molybdenum, Japan, Mexico, Bitcoin

Tech sector rout gives buying opportunities. Moly falls and bounces. NVIDIA becomes a lot more than a video games chip maker, NVIDIA. And the Bitcoin rollercoaster hits some down days.

Bought

General Moly Inc (GMO): Molybdenum Mining. In TIB19, I wrote about the move in molybdenum prices (a material used in steel making) and a trade I made in General Moly (the post says Western Moly = a mistake). From the chart you will see that the trade was looking quite heroic with a doubling rise in a few weeks.

Price then drifted back to below entry point. I was excited to see a bounce over two days last week to take price back over 50 cents which tells me there is life in the molybdenum price. I put in an order to increase my small position and got a partial fill. There is nothing in my original thinking that has changed. Economies are growing and I expect demand for steel and molybdenum to grow. All that has changed is an oversupply situation in China which has affected steel related commodity prices over the last few weeks. Today China confirmed industrial production rose by 6.5% annually which was a bit of a surprise for markets

NVIDIA Corporation (NVDA): US Technology. NVIDIA bills itself as the world leader in visual computing technologies. Its share price has been on a rocket ship with a 5 times increase since early 2016. I do have exposure to it through holdings in Technology Select Sector SPDR ETF (XLK) but it is only 1.75% of this ETF. Looking at the chart suggests that one might be a bit optimistic about getting much more out of the stock.

There were two items of news that grabbed my attention. NVIDIA has been all about video gaming and the headlines were talking about two new market areas in which NVIDIA processors could be key players. First is machine learning and artificial intelligence - one can add in virtual reality and autonomous driving. I have been watching the whole AI world for a very long time and have not yet found a way to invest in it - most of the work is being done in startups which are not tradeable. Second is the prospect of NVIDIA and Advanced Micro Devices (AMD) working together to make cryptocurrency mining cards.

With most cryptocurrencies reaching massive new highs this last week, demand for mining equipment is soaring. These two areas makes NVIDIA a completely new business and we need new ways to value the business.

https://videocardz.com/70162/amd-and-nvidia-preparing-graphics-cards-for-cryptocurrency-mining

I first thought about the idea last week Thursday (June 8) and had a trade window open ready to place the trade. The chart just looked too toppy for words and I had cover via XLK. Trade did not go on. Friday and Monday sees a big pull back in technology stocks and NVIDIA corrects $26 on the week's high of $168. That feels like a 15% discount to me on an idea that is forming as a strong investment theme (AI). Trade went on on a small scale.

Technology Select Sector SPDR ETF (XLK): US Technology. While I was thinking about the NVIDIA idea last week I decided instead to add another rung in the XLK options staircase. Premium for January 2019 strike 61 call options was just under 5%. I am figuring that technology stocks will easily add 5% more with solid economic growth. Well it seems the market had other ideas and started a rotation out of technology stocks after I placed the trade. That is fine with me - I added in another contract on Tuesday trade at a 15% discount. Let the waiting begin.

iShares MSCI Japan (EWJ): We talked in our investing group last week a lot about Japan in the context of relative market valuations. As you know I use price to book value ratios a lot as a way to choose stocks to invest in. Why not do the same for markets as a whole? My coach shared a valuation service that does just that. I have sorted the table into ascending price to book value ratio (i.e., worst is the top).

The lowest is Russia (note the data is March 2017) followed by South Korea and China. Japan appears in the list as in the worst 10 with a price to book of 1.3. I already have invested actively in Japan at specific stock level targeting price to book value ratios less than 1. This trade is something of a marker trade to see how this pans out at a country level and as a benchmark for other trades using this idea.

I have marked off the other countries that I already have exposure to. My plan will be to revisit this list and reduce exposure to markets not on this list (i.e., with price to book value ratio higher than 1.5 (say)). I will overlay with this metric GDP and population growth as a parameter. More on this topic later.

http://www.starcapital.de/research/stockmarketvaluation

Note: On this table I only use Price to Book Vale (PB) and Price to Sales (PS).

I bought January 2019 strike 55 call options at a premium of 6.6% to strike. Current price $54.56. I am figuring that Japan (black bars) only has to close half the 40% gap to the S&P 500 (orange line) to make this trade a solid winner.

Note: EWJ is listed in US Dollars - so this chart is all in US Dollars.

Shorts

Brambles Limited (BXB.AX): Supply Chain Logistics. I missed my research house had trailed their stop loss. It was just as well as I was able to close the trade for a 1.2% profit in 2 weeks and they made a loss.

Westfield Corporation (WFD.AX): US/UK Shopping Centres. I have written a few times about the weakness in US Shopping Malls (see TIB82 for the detailed rationale and TIB77 for the first short on Westfield) I have been waiting for a reversal to go short again. Friday was the day. I am currently running this trade without a stop loss as price has been quite volatile up and down.

Japanese 10 year Government Bonds (JGB): June 2017 futures expiry rolled over automatically to September 2017 futures for a 0.516% in 3 months loss which looks harmless enough but these are large contracts (4 in total) and total loss was $5,630. I had closed one contract out last month to bring that loss back by $270. I have clawed back a little more of the loss by closing out one of the contracts for a 0.11% profit clawing back another $300. This leaves 3 contracts open - and they are currently profitable.

This trade idea feels like a widow-maker trade with 10 winners and 30 losers over the last 4 years. I am beginning to feel like some of those investment gurus out there who have been banging on about the next market collapse or the next big run-up in Gold. Japanese yields have to rise - the problem is I have been wrong 75% of the time over the last 4 years. Does that make the probability of being right this time any different? My investing coach talks about this topic quite a bit. "Keep doing what is working. Stop doing what is not" is one pattern. But he also talks about "Never good to lose out on an idea the minute after you stop pursuing it". I have worked myself into a bit of a hole here on JGB's - this is the time to draw a line and stop doing it. The trades are on - they are profitable and I did reduce the exposure. Expiry date is 3 months away - time to wait and watch the Bank of Japan and the Federal Reserve duke it out on interest rates.

Covered Calls

iShares MSCI Mexico Capped (EWW): Sold July 2017 strike 55 calls for 1.17% premium (1.14% to closing price of $53.72). Price needs to move another 2.4% to reach the sold strike. Should price pass the sold strike I book a 5.8% capital gain. This is a new covered call prompted by an article I read about covered call strategy. The article said to write covered calls on stock you are planning to hold where price is going sideways or even a little downwards to collect some premium to mitigate the stall.

My thinking is a little different here. Mexican stock market values have moved ahead strongly with the stabilising oil price and the weakness of the Mexican Peso following the Trump Mexico bashing. On a price to book value (2.3) basis, the market is now possibly over valued - if I get exercised I am happy to exit. Mexico is at the other end of the table I used for Japan above.

If I can collect some call premium along the way I am happy too.

http://www.starcapital.de/research/stockmarketvaluation for the PB ratio

Cryptocurency

Bitcoin (BTCUSD): The trading journal is a powerful way of keeping track of what you actually do compared to what you say you are going to do. I said I was going to ride out my last trade without a stop loss as I had a trading buffer from two profitable trades. I also talked about being patient and waiting for reversals before entering new trades. I have made a number of trades since last Friday - was I true to my strategy?

My broker does not offer Bitcoin CFD trading every day of the week even though markets are open. When markets open on Sunday evening my time there is often a large price gap. This is when I start to play MIND THE GAP. Sunday was no exception as price gapped up considerably. Price not only gapped up - it raced up to test the all time high $3,000 level. I shared a post the other day about the importance of this level as a target price where I figured there would be a lot of take profit orders.

Price respected the gap for several hours and started to look a little toppy around the $2950 level - that is when I changed my strategy and I put in a stop loss just below $2900 but above the gap as I believed the market was respecting the gap. That stop loss was triggered at $2895 for a $18.10 per contract profit (0.63%) over the weekend. That reads like a smart amendment to strategy that put money in the bank.

The next step looks pretty daft (but it is totally consistent with what the cavalier trader in me has been doing). That first drift below $2900 was just a fake move and price moved back above $2900 strongly. So I put on a new trade (with no stop loss) at $2953 - back to core strategy to hold one contract open without a stop loss. This is when the big dump happened and exposed the error of my trading ways. I had not waited for a clear reversal to re-enter the trade. The next chart shows the game to play after MIND THE GAP. It is called the trend tracking game HIGHER LOWS. The idea is to wait for the reversal to form a higher low and enter the trade there.

That last higher low at around $2650 would have been a lot better place to be entering a new trade - like $300 better. As it happens the game changed again as the higher low was taken out and we got a dump of $487 below my entry point to make a LOWER LOW. Lesson learned again - one day it will sink in. I am OK with my trade where it is as I do have buffer that I have built up and I do believe that long term Bitcoin price will keep advancing.

Now was the time to start working on reversals and trade the way back up. I have worked patiently on a 15 minute and 30 minute chart to identify reversals and pullbacks. We see on the 30 minute chart that price found a bottom around $2500 - tested it again and made a series of higher lows.

My trades slotted in on a few of those reversals - not trying to time the turn but waiting for a confirmed reversal - two consecutinve rising bar and trade above that. So far I have completed two transactions for profits of $33 (1.18%) and $43.60 (1.62%) per contract. Current status is I have two contracts open - the ugly one and one entered at $2746 which is currently profitable.

Currency Trades

No trades while I await the Federal Reserve decision

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas. I do participate in an investing group - some of the ideas flow from there.

Images: I own the rights to use and edit the Buy Sell image. Headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: If you want a low cost way to enter Bitcoin, you can buy a package for as low as €50 (in Bitcoin) and earn Bitcoin at a rate way better than your bank could offer - think weeks instead of months. http://mymark.mx/USIBitcoin

June 13, 2017

I've been keeping an eye on NVIDIA as well but had not thought of this opportunity for their business growth.

Tweeted

https://twitter.com/profits_bitcoin/status/874851393038942208

Disclaimer: I am just a bot trying to be helpful.

Great post. I like NVIDIA, although this stock has been one of the best performances in S&P 500 last years. Artificial intelligence could be a game changer.

Interesting post, thanks!

Professional Trader? Thanks for your upvote! My turn!

I run my own investments. I live off what I do but nobody else pays me.