TIB: Today I Bought (and Sold) - An Investors Journal #12 - European Banks and Insurance and Pacific Drilling.

First day back with my investing coach was a refresher on beaten up things we will explore. We are looking for turnarounds. For the day's trades I keep doing what I have been doing

Bought

Pacific Drilling (PACD): With oil price rising on an OPEC deal, we expect oil services companies to do better working upwards from the lowest cost to produce upwards. Offshore drilled oil is the most expensive oil - so the drillers will be the last to show improved business. The big players tend to improve faster than the small players and we see this in offshore oil drilling with the largest player Transocean (RIG) already showing a break above its downtrend line.

The chart for RIG tells the story - smashed down as the oil price fell and beginning to recover now. Now I bought shares and options in Transocean in May 2016 (when it first broke out) - shares are up 40% since then. Now what I am looking to do is to add exposure through the smaller players to add to the asymmetry in the trade. The small players will (mostly) follow the big players. Now the problem with the small players is you cannot be sure which ones will win and even if they will survive. So I buy a small stake when the signs of recovery emerge - if it drops more I add to the small stake and if they break out I scale in - but always keeping position size quite small.

Pacific Drilling S.A. is an international offshore drilling contractor operating in deep water in US, Gulf of Mexico and Nigeria. Market capitalisation is $101 million = 1.8% the size of Transocean (RIG). I had already bought a small stake ($1,000) in December 2016 which has fallen by more than 10%. So I added another small stake ($500) - my standard position size is around $20,000, which gives you an idea what I mean by a small stake. Now that I dig into the business, I see operating margins in 2015 were 29% and a little lower than that for Q3, 2016. Not bad considering the challenging business they are in and the depressed oil price - and quite a few points higher than RIG (18.7% in 2015). This gives me encouragement

Note on RIG: I had bought options in 2013 when price broke out then. It was looking good for a while but not anymore. I am winning back now.

Zurich Insurance (ZURN.VX) December 2021 Call 320. I have already reported in episodes #8 and #10 about adding call options in Zurich Insurance. I will explain a little more of the rationale.

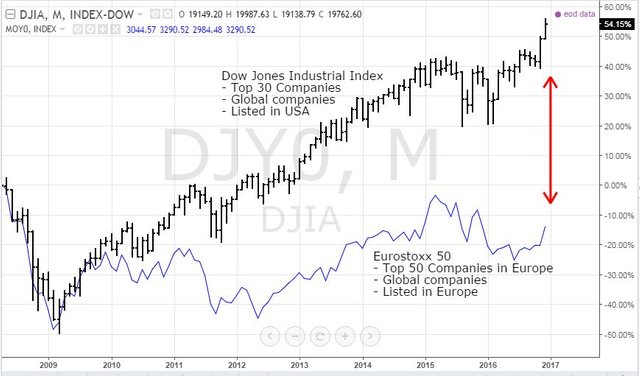

In the US, since the last major pullback in October 2011, one insurance company, American International Group (AIG) price has risen 253% whereas the S&P500 has risen 111%. So investing in that insurance company was twice as profitable as investing in the whole market. Now you already know that I have a leaning to invest in Europe as I believe Europe will close the gap on the US performance - this chart from #9 (December 31, 2016) shows that

Will this divergence between the whole market and financials play out in the same way in Europe? Well it is - Aegon Insurance has gone up 63% and Europe only 23% - but nothing like the pace that we saw in US. The sad reality is Aegon, for example, was up 167% and has drifted back to plus 63%.

Now let us look at the Buy:Sell charts. First one plots Buy S&P 500 (represented by the SPDR ETF SPY ) and Sell European Financials (represented by the iShares Europe Financials ETF (EUFN)). This turned over in August 2016. That confirms for me that adding European Financials was a smart move - though I did move earlier than the chart said I should

Now the next chart goes into the split between banks and insurers and Buys a bank (represented by US ADR's of ING - a Dutch bank) and sells Insurance (represented by US ADR's of Aegon Insurance - a Dutch insurer). This shows that investing in banks was better than insurance until October 2016.

If we believe that Europe will catch up with US and that the AIG story is a sampling of how much insurance can outperform the market, investing in European Insurance makes sense.

Now let us take a little step back. Insurance companies make their income two ways. They sell policies for a premium to cover risks (called underwriting income) and they invest (called investing income). When the economy grows they can sell more policies and can increase premiums and thus underwriting income rises. When markets and interest rates rise, investing income rises though they do give away on the falling prices of fixed income investments (insurance companies have to hold a defined proportion of fixed income investments). All we have to do is believe is that Europe is growing to believe that insurance companies will grow. We already know interest rates and share markets are rising. I will dig into this in another episode.

How did I express my view? I already hold shares in Zurich Insurance (up 31% since April 2016). I already own "in the money" options expiring in December 2020 (current price of SFr284.10 is higher than the strike price of 280). I also have December 2020 call 320's which are "out the money". The 2021 options were 13% more expensive to give me another year of time to be right. I thought that was a reasonable price for the extra time. On the next chart I have laid this out - weekly chart of Zurich Insurance.

Strike price is 320 - the lower green line. The next line up is breakeven to cover the Sfr18.25 I paid. 100% and 200% profit lines are shown above that. The dotted vertical line shows the December 2021 expiry date. Now I have drawn in an arrow from the bottom of the last move up tot he top of that move and cloned it across to the current move up (same length and same angle). This tells me there is plenty of scope to reach 200%. At the top of the chart we see a line which shows what AIG has already done in the US market from its bottom in October 2011. If Zurich does what AIG has already done, this trade will make more than 400%.

Commerzbank (CBK.DE) December 2021 Call 10. Adding in 2021 call options as part of theme of leaning European Banks exposure to the under-performers (i.e., reducing ING and growing CBK). http://mymark.mx/TIB7 to see the rationale for this switch

Currency Trades

Been keeping quiet on the currency front. I remain long the USD and short EUR and CHF. I added a EURCAD long position after seeing the strong pullback in WTI Crude Oil price. Canadian Dollar (CAD) weakens when oil prices fall and the EUR had been oversold. This also gives me a little bit of a hedge on my short EURUSD position.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas. I do participate in an investing group - some of the ideas flow from there.

Images: I own the rights to use and edit the Buy Sell image. All other images are created using my various trading and charting platforms. They are all my own work

January 10, 2017